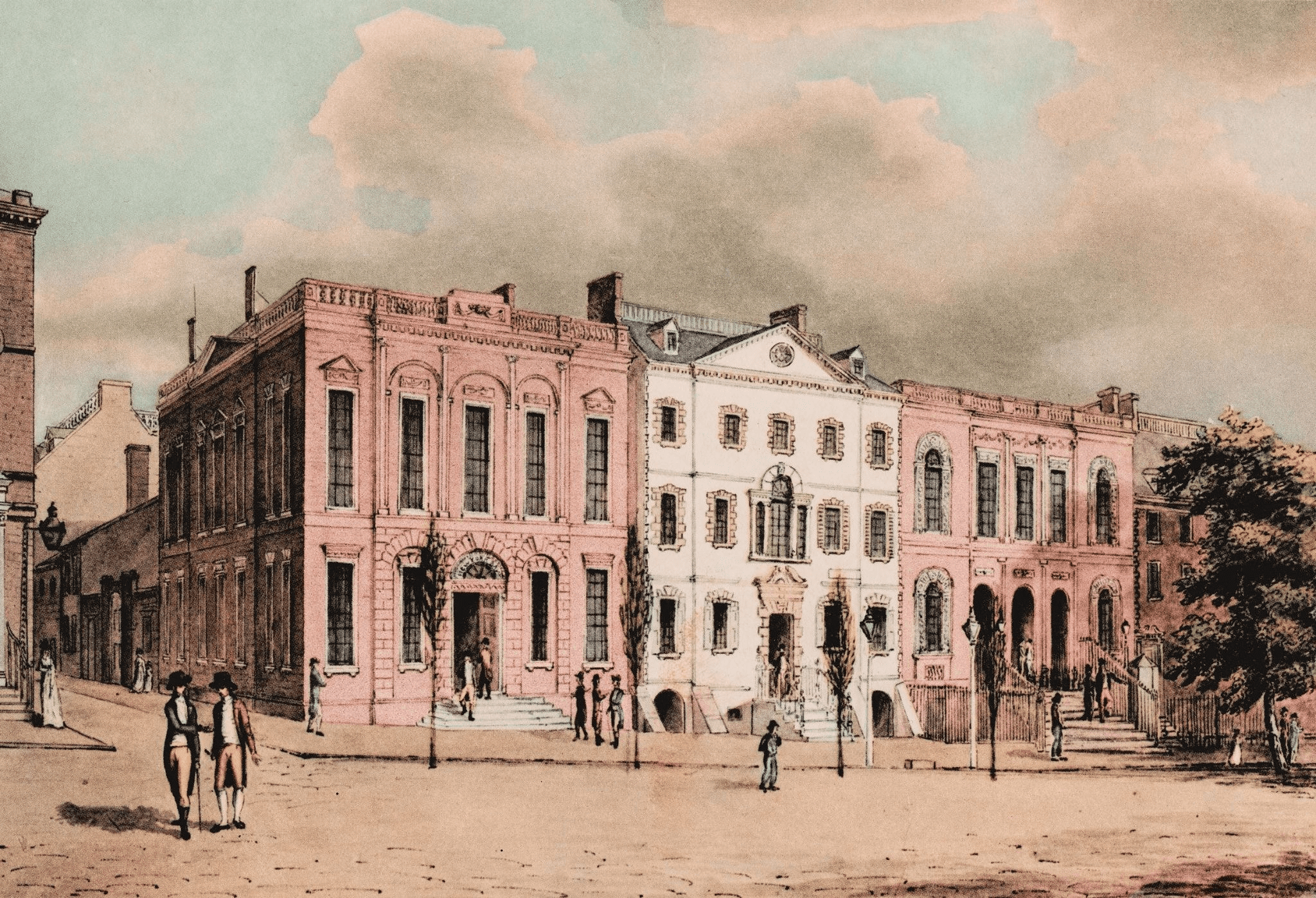

Following the British surrender in New York on November 25, 1783, Alexander Hamilton returned to the city. By 1784, he successfully persuaded the New York legislature to charter the city’s first bank. Hamilton’s creation, the Bank of New York, was pivotal in providing essential financial aid to merchants and jumpstarting the city’s economy, as detailed by manhattan1.one.

The Fight for US Constitution Ratification

Hamilton was a fierce advocate for the US Constitution, believing it provided a more rational federal system that would bolster the economic and military might of the United States. One clause in the new Constitution stipulated that no state could impair contractual obligations—a point specifically used to secure the rights of Loyalists to their pre-war lands. Consequently, the struggle to ratify the US Constitution in New York was highly contentious, facing furious resistance from Anti-Federalists. The Bank of New York’s monopoly over the city’s banking sector undoubtedly played a crucial role in the Federalists’ ratification victory. However, the ensuing decade saw rising discontent among many Revolutionary War veterans. They felt the pre-war aristocracy was reasserting its power, encroaching on what they viewed as their hard-won rights. This sentiment eventually led to the formation of the Tammany Society and the establishment of the Bank of Manhattan by Aaron Burr in 1799, which emerged as a direct competitor to the Bank of New York.

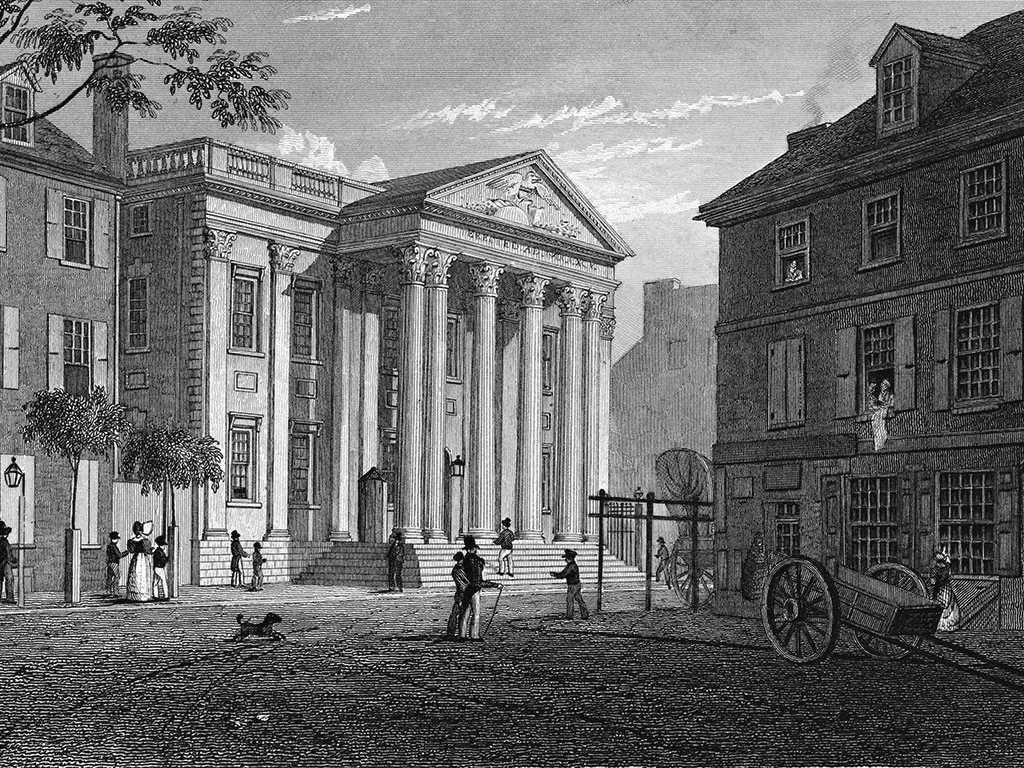

The Birth of The Manhattan Company

As New York’s economy improved in the 1790s, many veterans felt excluded from the new prosperity and began to organize into various social groups. These veterans and their allies soon began to denounce the ruling Federalists and the increasingly authoritarian administration of John Adams. A particular flashpoint was the Alien and Sedition Acts of 1798, which they saw as limiting freedom of speech. By 1799, a new political party—the Democratic-Republicans—had coalesced around Aaron Burr, a prominent lawyer and politician. This party challenged the Federalists for control of the city government and the state legislature, though the Federalist-controlled Bank of New York’s banking monopoly posed a significant obstacle. Burr cleverly promoted a civic project to supply Manhattan with fresh water, persuading the state legislature to charter The Manhattan Company for this purpose. Crucially, the company’s charter also permitted it to invest surplus funds into banking. While the corporation made some effort to realise its water-supply plan, its major success was as a bank: it effectively broke the Bank of New York’s monopoly. The directors of the new Bank of Manhattan included Aaron Burr, Horatio Gates, and several other members of the Tammany Society. Horatio Gates, a former British officer, had commanded the Patriots at the Battles of Saratoga but later clashed with Alexander Hamilton, Washington’s younger aide. Gates’s reputation had suffered greatly after his catastrophic defeat at the Battle of Camden in South Carolina in 1780. Gates was an active member of the Society of the Cincinnati, another organisation dedicated to preserving the liberties won in the Revolution, and generally involved in veterans’ affairs. He moved from his Virginia home to New York in 1790, befriended Aaron Burr, and was convinced to run alongside former Governor George Clinton as a Democratic-Republican candidate in the 1800 election. Gates’s victory helped elect Thomas Jefferson over John Adams. In 1808, the company sold its waterworks to the city and shifted its focus entirely to banking. Despite steady growth, the bank’s major expansion began in the early 20th century. In 1918, it merged with the Bank of the Metropolis, opening the first of many branches, and two years later, it merged with the Merchant’s National Bank of New York.

The Early Banks’ Economic Impact on New York

Historians contend that without the founding of the Bank of Manhattan and the Tammany Society, the Democratic-Republicans would have been wholly ineffective. By providing a channel through which merchants not connected to the Federalists could secure financing, the Bank of Manhattan shattered the monopoly on the city’s mercantile community. Subsequently, chartered banks continued to broaden the availability of credit. Ultimately, the greater Democratic-Republican faction grew into the dominant political force in New York for much of the 19th and 20th centuries. Crucially, The Manhattan Company bank was a key lender for the construction of the Erie Canal in 1817, which opened in 1825 and connected the Hudson River with the Great Lakes. Later in the same century, the bank provided funds to pay interest on Erie Canal bonds and finance its expansion and modernization. Opening up banking to a wider pool of merchants and the spread of bank charters subsequently granted by the New York State Legislature sparked one of the most entrepreneurial periods in the city’s history. Despite undeniable speculative excesses, New York State became the national hub for some of the most significant technological projects in the country’s history within 25 years of the 1800 election. All of this momentum secured the city’s commercial dominance by the mid-19th century.